Please see

parts 1 and

2.

So I confronted Sonya with this image.

In it I asked, "Why is a 73 year old woman living in a senior home paying child support??" and "Did Carole get to ride in the Ubers? Did she make calls to people in prison? She paid for it. And moving money isn't fooling anyone. If you can prove that the money isn't fooling anyone. If you can prove that the money you spent on yourself and your kids is from money you made and not just spending down your mother's retirement, I'll eat crow. You squandered your mother's retirement nest egg. Her health has suffered as a result, When she dies, part of it will be your fault."

Up until then I had held my tongue, and just said there was a rift between brother and sister. I had mentioned this to Kay and maybe Mike1, Sonya's sons. But as I said, I was on parental leave with Mike2 and maybe had too much time on my hands. Mike2 was a 3 month old at this time so, I was running on no sleep so I was weak. However, my sense of justice is still annoyed that she was able to get away with doing this to the woman who raised her.

Anyway, this was her answer:

I'm going to try to translate this into Standard English. I'm also going to comment:

"Well finally some communication and yes, I see your point. Now I am able to explain these things. I will show my bank statement for US Bank that shows that $10,000 from child support was levied out of the account and I got $8,500 from my tax return, that was paid to them, so ultimately, $1,500 was her money."

Okay, I'm a Humanities major so I don't do math all that well, but this is BS. If she had her own bank account why wasn't she

using that for the medical weed and the cigarettes? I doubt such an account exists. Regardless of how much Sonya got from her tax return, the $10,000 was all Carol's money, not $1,500. Sonya should not have been mixing her own spending with her mother's account. She abused her role as POA.

"and I will talk about me moving and breaking the lease in 14 days from March 2016 when he had the conservatorship freeze the accounts. I had days to pay the rent or quit. I was left destitute having to move with the kids and there was no explanation as the what the Hell was going on."

She decides to switch the topic. She also has mistaken me for her brother Mike, and thinks I can be guilt tripped. She has since discovered she can't manipulate me, and has asked Mike to keep me out of the loop and asked me never to contact her. The situation she is talking about here is something I like to point out to Mike to show him there was nothing he could have done to stop his sister from becoming the POA and ruining their mother's life. The lease for the house she rented for their mother was supposed to end either in late March or April. Sonya got it in her head that she could continue to rent the place. Mike asked her to let the lease end, and of course, she ignored him. There was no reason why Carol, the mother and real victim here, should have had to pay for a house that was in better condition than the place she was living in, and pay for the room where Carol was living.

During this time the

Santa Clara Adult Protective services social workers were probably telling her that the accounts were frozen in

March and

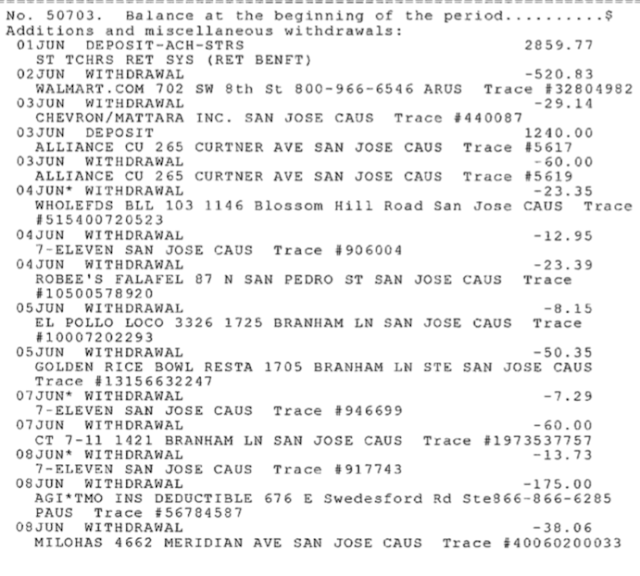

April. Looking at the bank statements, it doesn't matter because there are more than 6 pages of spending for those months. And the credit union, which I'll call the bank for simplicity's sake, did not freeze the account until the 1st of June. And Mike didn't get any sort of conservatorship powers until May, and even then a lot of places kind of ignored it.

Another thing, and I'll get back to Sonya's screed, once Carol was out of the three bedroom house Sonya should have realized that the end was near and she'd have to put on her big girl pants and support herself.

"The District Attorney for Adult Protective Services came to my house to interview me and potentially arrest me for the claims made my anonymous people of financial abuse."

Hi, I'm Mike's wife and

this blog is about how Sonya abused her mother. I gather the bank and later the social workers at Kaiser tipped them off. Sadly, nobody arrested Sonya.

"The District Attorney after the interview and a detailed investigation of that very Alliance account with a fine tooth comb, said there is absolutely no proof of these crimes and found me innocent on all charges and closed the case. So the law says I did not do that."

What stopped the investigation was Mike becoming the conservator in order to save his sister from going to jail. Mike is horribly loyal, sometimes for the wrong reasons, and that's why it has been so frustratingly hard for me to get him to file charges. To my knowledge she was never brought to court so no one has found her innocent.

"The freeze was lifted and I was left being homeless and ultimately having to find a home."

Sonya had used money on

May 16, 2016 to get a U-haul for $330. So no freeze then.

"My business was on the brink. I had just opened the doors not even a month , which was going to pay all the money back, but unfortunately Michael chose to read without question and make me out to be this bad person. I have an answer to all these and it's all very long, involved and many intricate details..."

And all BS.

"I will not accept that I spent all my mom's savings, that's absolute bullsh!t. And he has no idea of how it is to be on the frontlines to care for her, my 3 kids, and 6 student interns, as well as a plethora of clients to be shut down at a screeching halt. There was more to the story than the account and I was never asked or talked to or concerned with an alternative route so we would all be ok."

Denial, denial denial, then me, me, me. Obfuscate, obfuscate, obfuscate. One of those 3 kids is a grown man in college. As far as never being asked, Mike could never get a word in, so he never had an opportunity to ask and even if he did, Sonya would probably lie to him, like she did about the child support.

"My mom was forced to short sell her house in three days by Gene only getting about $500,000.00 when her house was worth $700-$800,000. Then she was forced to move into a senior community costing $7000 a month for two years. Anyway he can blame me, but how cowardly of him, when he didn't lift a finger to actually care for her a day in his life. As for him saying it will be my fault for her death, I will say the same about him."

According to Redfin.com, on December 5th the house was listed for sale for $545,000, it was under contract on the 11th and sold January 15, 2014 for $552,000. It's kind of hard for me to find comps for that area for 2014 in 2018. Yes, now houses are going for $700-$800K, but I did manage to find another house in the area selling in January 2016 for $625K. The house across the street sold in the Summer of

2010 for $350K. Carol and Gene had to sell because they kept falling in the driveway and having to call 911 to pick them up. Gene was a double amputee with a big a$$ truck. Because they were married the house belonged to both of them. Doesn't matter that it was Sonya and Mike's childhood home. The kids did not own the house.

Carol and Gene had to move into a senior community for their health. There was the constant falling because they were on a steep hill. Carol had worsening Parkinson's in addition to her Diabetes Type 1. Gene was also diabetic, with anger management issues. Senior care costs money. Sonya had complained about the last place Carol lived, nickle and diming their mother. No that was for services rendered! But all Sonya probably could see was money she wrongfully thought was hers slipping away.

Then she ends with another guilt bomb. The family dynamics at play here did not lend themselves to Mike doing more for his mother until the conservatorship. While Carol was married to Gene, Mike could just call his mother and have annual visits. Gene was a miserable old bastard and very untrusting. Carol was vague. Mike and Carol's phone and in person conversations (that I witnessed) had the depth of a thimble. Sonya and Gene hated each other. Mike tries to be the peacemaker, he didn't care for Gene but usually tried to be nice to him. Mike also respected the fact that his mother was married to Gene and there are things in a marriage that make the wishes of the adult children secondary. Gene had only been dead a month before Sonya became their mother's POA.

"I have more to say but I'm too heated and will message back when I find my documentation. Until then I'm not going to accept his irrational judgements against me period."

Never got any documentation... probably because there is none. Yes, these claims that we have with hundred's of pages of bank statements, the court investigator's report, and conflicting messages, all irrational.... This is why I fear for N Kim's (the little girl) safety. I want to reach out to her father because a woman who would deny the facts in front of her when presented would also be in denial if one of her loser boyfriends harmed that little girl. I will sleep on in. Next month, if I feel this way, I will.

"I did my best I could without having much opportunity to work and make an income. Even the law pays a family member to care for family, but because she was a teacher and didn't pay into Social Security, she was not eligible for those types of services. How was I supposed to care full time with no income."

She could have left well enough alone, and allowed Carol to stay at the

Atria. But no, she decided to take her mother out of the hands of professionals and DIY it. There might be a program that provides some money for

family members who care for other family members. That was probably though MediCal. Because of the generous pension Carol had, I don't know if she would have qualified. I was under the impression that it was Medi-Cal or Medicare that was providing the nurse who came in to care Carol... before Sonya threw her son across the room and frightened the nurse away.

Did Sonya do her best? Maybe the best that a chronically unemployed chronic enthusiast with anger management and other mental health issues who dropped out of school could manage. But even if she wasn't a crazy stoner high school drop out, the way she saw her mother, and brother as ATMs that she could use, would have resulted in the same way. We thought it was mismanagement, it was greed.

"The Uber stuff was Mike1 using the card to get himself to school and basketball practice everyday. So yes, I agree that was bad. But I also had faith all would work out because my business was already making a return."

Well one thing she admits not being good.

Why the heck did Mike1 have access to Carol's account? I don't blame the teen, he's a minor. Sonya gave him access.

So there we have it. Sonya only admits letting her teenage son have access to his grandmother's money was bad. But stealing her mother's money for child support and other things, she's in complete denial. There is no point confronting her with this unless I can convince (she's not the only one in the family who plays the denial game) her brother, to file charges. She cannot repay what she stole. Sonya has a negative net worth. She is no good at making money. Last we heard, she was homeless. I highly suspect Carol was providing Sonya with financial help well before the sale of the house and the moves to senior housing. The spigot has been turned off and Sonya is now forced with having to figure out how to live after burning (no, exploding) all her bridges.